The earliest form of credit in America was loans from shopkeepers. It was taken to buy furniture, groceries and farm products. This was way back even before the1900s. Then the first credit bureau was introduced in 1899 which collected financial data. Today the market size of credit bureaus and rating agency industry is $13.4 billion in 2022 and is expected to grow at a 6.1% rate. Around 45 million American adults in 2015 were ‘credit invisible’. This meant they lacked credit files with information to create a score or did not have a score. But today about 59.2% of the US population have a range in between 700-850.

Image Source: https://www.99acres.com/articles/role-and-importance-of-cibil-score-bgid.html

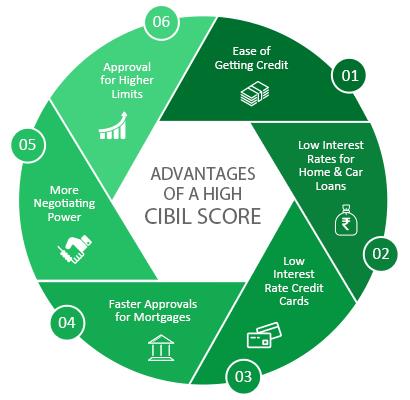

There are ample benefits of an excellent credit score (800-850). It boosts the likelihood of loan qualification, ensures credit card rewards, improves negotiating power and offers low loan rates. A credit union can contribute to increasing your credit score. They charge far lower fees than the banks do and offer good money management plans. Below are a few ways in which credit unions can help build a steady financial future.

Reasonable Loan Rates

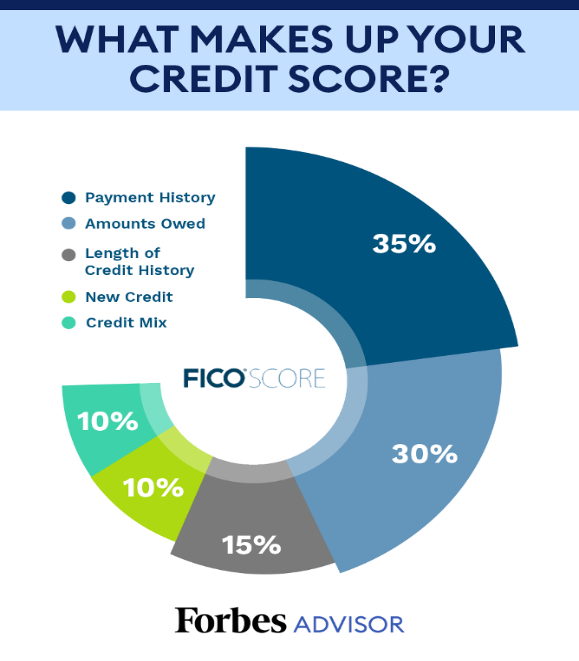

Opt for auto loans, personal loans and mortgages from a credit union. These organizations use the money deposited by members to offer the funds and can ensure lower rates. It then becomes easier to keep up with the instalments. You are able the pay the EMIs right on time without worries. So, there is no ‘default’ status in the credit report that can be factored in your score. It is vital since payment history accounts for 35% of the credit score.

Image Source: https://www.forbes.com/advisor/personal-loans/pros-and-cons-of-personal-loans/

You can see a gradual improvement in your credit score once debts are cleared within the stipulated deadline. Use a personal calculator to figure out which repayment term would be ideal for you. You can easily become a reliable and low-risk borrower and might be able to dictate the loan terms and conditions too.

Low Fees and Charges

There are ample ‘no-fee’ loan applications. Opting for them can lower the overall expenses to a great extent. You can also enjoy affordable rates for transfer and overdraft and almost no costs for ATM transactions. Or else these fees can add up to a huge amount. The members are willing to work with you to make sure the borrowing experience is as budget-friendly as possible. This ensures better money towards paying off debts and unpaid bills. It can help to shoot up your credit score within minimal time.

Auto Payments

Building an impressive credit score means timely payments. A hassle-free way to establish this is to set up an auto-debit system. This can ensure that all your dues like credit card bills, mortgages, EMIs and rents are sent to the respective creditors. You are able to keep up with all the payments by scheduling them ahead of time at a pre-decided date.

This is especially necessary if you have recurring payments on your shoulder. Simply link your check-in account with all the loan accounts so that all payments are done in full at the set intervals. This is the simplest way to ensure a healthy credit score without having to monitor your records constantly.

Higher Savings

Credit unions enjoy tax exemption benefits which are passed to its member as higher rates of deposits and savings. This financial sector is not focused on profit and does not serve its investors. They are member-oriented and are able to provide great saving opportunities. You can enjoy high-end returns that help to fulfil liabilities. With more money comes the ability to clear outstanding loan balances. Tick off your auto loan, home equity loans and personal loan right on time without late payment fees. Now you can ensure a better credit card report with a solid payment history over the years.

Unsecured loans do not ask for collateral. They come with a 60 months term which is a great option to help create a perfect credit score. You can pay the balance without wreaking havoc on your savings or emergency funds. Strategize your payment accordingly for the best results. Further, work closely with members to establish strong financial habits and receive tools and knowledge for a great credit report.