Have you ever wondered, what it’s like having financial stability? Imagine you wake up the next morning and you have enough money saved for your retirement or an emergency. You go to work, do the daily chores and buy the things that you need without worrying about your finances.

It’s hard to believe but financial stability is still possible while having a day job. In fact, it’s way easier than starting a business. If all you need is financial stability, money for your retirement and emergency, then it’s probably better to aim for financial stability than starting a business.

What is financial stability and why you should aim for it?

Financial stability is the ability to pay your dues, not having debt and spending your days without worrying about savings or retirement.

Most people confuse financial stability with financial freedom, passive income and having 10 rental properties. That’s the reason, only few achieve financial stability in their lifetime.

A financially stable person is confident in his decision, manages his finances, is usually stress free and takes care of his needs. They have better relationships, are able to enjoy their favourite concert or vacation and buy the things they need.

That’s the reason you should aim for financial stability. Here are some of the major steps that you must take in order to achieve financial stability without leaving your day job.

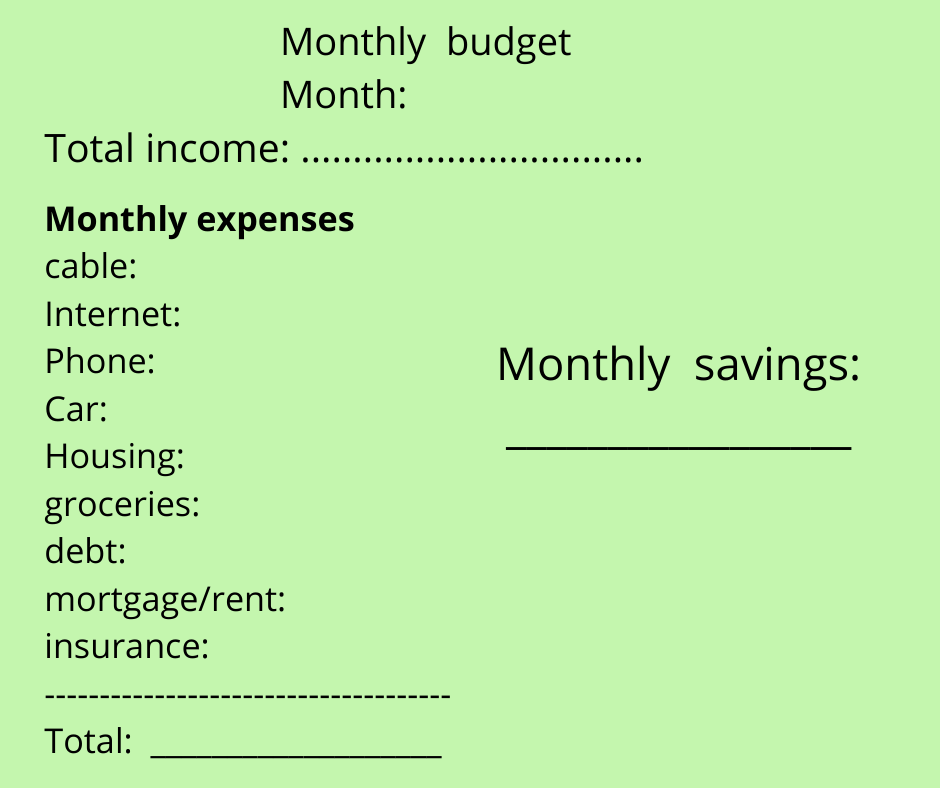

Start budgeting:

Budgeting is the first step towards achieving your financial stability. It helps you to figure out your income, expenses and plan out your financial future.

Start from cutting out your unnecessary expenses. From brand new gadgets to trendy clothes, don’t buy them unless you really need them.

Have a keen eye on your income. It’s better to manage your spendings and make sure it’s below your monthly earnings. Plan the necessary spendings that you’ll do for the month. Make a list of the things that you need, it’s cost and how much you’ll spend for the entire month.

Live below your means:

Most people confuse living below your means, with living frugally. As you start your journey of achieving financial stability, it’s vital for you to live below your means. This basically means, spending money on the things that you need and only when necessary.

Maybe, you go out for dinner every night with friends and family. While it’s still possible for you to enjoy dinner at home, and go out, once or twice in a month. This way you’ll save a lot of money.

If there’s something you need, like a new pair of shoes, clothes or some appliances. Make sure you look at the finances before you make a decision. Purchase the items only when necessary and manage your finances in a way, so that the expenses won’t exceed your income.

Pay off your debt:

Student loans, personal loans, credit card debts and mortgages are some of the bad debt that you might have. It’s preferable to get out of it before it interrupts your financial plan. A huge burden will get off of your shoulder once you’re out of it.

Don’t go out for a lavish dinner for the next 12 months, cut your credit cards, abandon your expensive hobbies and other things that are categorized as unusual expenses.

Start a side hustle:

You don’t necessarily have to start a business, work for extra 5 hours at starbucks or deliver pizza at the nearest park. Any skill can be capitalized on in this modern era of the internet. And it’s possible for you to make money online.

However, it’s easier said than done. But there are countless number of people who’re making a decent amount of side income by freelancing, blogging, or selling a course or an eBook.

If you’re a middle aged man or woman, student, or even employee, think of the things that you’ve learned so far. It doesn’t have to be professional, it could be anything. Like social skills, public speaking, programming, web design, graphic design and so on. Now, think of every possible way those skills can be capitalized.

You’re already proficient and have a better grasp of some skills than an average person. You just need to manage your time and find an ethical way to help others do the same.

A side hustle will add an extra dose of income to your monthly earnings. This will help you to pay off your debt, start savings or even spend some money on the things that you need.

Start investing:

Socks, bonds and real estates are some of the well known investments that you can make to achieve financial stability. The number one mistake almost everyone makes with investment is, they invest first and learn the lessons later. That’s a wrong strategy.

Learn everything about the investments and talk with legal advisers and professionals before you make an investment. This will save you from unusual losses.

Start an emergency fund:

A recent car repair, get together, gifts, health check ups, summer vacation and other basic needs escalates your monthly expenses. It’s better to have an emergency fund, save a decent amount of money every month and use it when the needs arise.

This relieves your stress and burden. It also gives you extra space to make sound financial decisions and plan your finances.

Save for Retirement:

It’s said that “the younger you plan for your retirement, the better.” But if you follow the above mentioned steps, it’s easier to plan your retirement at any age.

The time will arise when all you need is free time for yourself and your family. That’s why planning for your retirement is the crucial step in achieving financial stability.

The conclusion:

It’s still possible to achieve financial stability without leaving your day job. Don’t make the same mistake everyone makes. Read the above mentioned steps carefully and follow the necessary steps that you must take in order to achieve financial stability without leaving your day job.

[…] The leverage mainly depends on the choice and budget of a trader. The higher the leverage, the more money you’d have to offer up for open trade. Choosing the correct leverage will allow you to earn more money through your trades and achieve financial stability. […]